UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(A)14(a) of

the Securities

Exchange Act of 1934 (Amendment No.)

|  |  |  |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

ALPHABET INC.

(Name of Registrant as Specified Inin its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of | ||

| No fee | |

| Fee paid previously with preliminary materials | |

| Fee computed on table | |

| ||

| ||

Notice of 2016 Annual Meetingof Stockholders and Proxy Statement

Alphabet Inc.

1600 Amphitheatre ParkwayMountain View, California 94043(650) 253-0000

April 29 , 2016

We are pleased to invite you to attendparticipate in our 20162024 Annual Meeting of Stockholders (Annual Meeting) to be held on Wednesday,Friday, June 8, 20167, 2024, at 9:00 a.m., local time,Pacific Time. We have adopted a virtual format for our Annual Meeting to provide a consistent experience to all stockholders regardless of location.

Alphabet stockholders of Class A or Class B common stock (or their proxy holders) as of the close of business on the record date, April 9, 2024 (Record Date), can participate in and vote at our headquarters at 1600 Amphitheatre Parkway, Mountain View, California 94043. For your convenience, we are also pleased to offerAnnual Meeting by visiting www.virtualshareholdermeeting.com/GOOGL24 and entering the 16-digit control number included in their Notice of Internet Availability of Proxy Materials (Notice), voting instruction form, or proxy card. All others may view a live webcast of ourthe Annual Meeting through our Investor Relations YouTube channel at https://www.youtube.com/c/AlphabetIR.AlphabetIR on June 7, 2024, at 9:00 a.m., Pacific Time.

DetailsFurther details regarding admission toparticipation in the Annual Meeting and the business to be conducted are described in the Notice of Internet Availability of Proxy Materials (Notice) you received in the mail and in this proxy statement. We have also made available a copy of our 20152023 Annual Report to Stockholders (Annual Report) with this proxy statement. We encourage you to read our Annual Report. It includes our audited financial statements and provides information about our business.

We have elected to provide access to our proxy materials over the Internetonline under the U.S. Securities and Exchange Commission’s “notice and access” rules. We are constantly focused on improving the ways people connect with information and believe that providing our proxy materials over the Internetonline increases the ability of our stockholders to connect with the information they need, while reducing the environmental impact of our Annual Meeting. If you want more information, please see the Questions and Answers section of this proxy statement or visit the 2016 Annual Meeting section of our Investor Relations website.

Your vote is important. Whether or not you plan to attendparticipate in the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet,online, as well as by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction form. Please review the instructions on each of your voting options described in this proxy statement as well asand in the Notice you received in the mail.

Also, For more information, please let us know if you plan to attend oursee the Questions and Answers section of this proxy statement or visit the Annual Meeting by markingof Stockholders section under the appropriate boxheading “Governance” on the enclosed proxy card, if you requested to receive printed proxy materials, or, if you vote by telephone or over the Internet, by indicating your plans when prompted.our Investor Relations website at https://abc.xyz/investor/annual-meeting/.

Thank you for your ongoing support of, and continued interest in, Alphabet. We look forward to seeing you at our Annual Meeting.

Sincerely,

|  |  | ||

ALPHABET INC.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

| ||

| Sundar Pichai | ||

| Chief Executive Officer | Chair of the Board of Directors | |

| April 26, 2024 |

Alphabet 2024 Proxy Statement 2

Dear Fellow Stockholders,

Looking back across the last 25 years, our Board is proud of the contributions Alphabet has made to many of the foundational technologies of our time. Whether offering a better way to search the web, send email or even navigate the world, Alphabet’s commitment to research and innovation has made it possible to turn technology into accessible and helpful tools used by billions of people.

The company has continued to innovate over the past year, and our Board is pleased with the advancements that have been made, particularly in AI. There has been great progress this year in Google Search, with the launch of the Search Generative Experience and many other AI features. And in December, Google launched Gemini, the company’s most capable and general AI model, to deliver more helpful experiences across its products and services. It’s all very early days and the company is well positioned.

Looking ahead, we are committed to overseeing investments for the long-term with discipline and applying Alphabet’s resources responsibly as it continues to unlock the growth potential of AI across its products and services. Developers are using Google’s models and infrastructure to build new generative AI applications, and globally, enterprises and startups are growing with our AI tools, using Google Cloud. Businesses of all sizes use Google’s ads products to drive growth, and AI has been fundamental to many of the Google Ads tools developed over the past decade.

Our Board works closely with Sundar and the management team to oversee the company’s AI development — guided by the AI Principles the company first published in 2018. The collective experience of our directors — including Google’s founders — across science, academia, technology, and business is invaluable as we help guide Alphabet’s progress during this transformational time in computer science. Regular reports and updates from the Audit and Compliance Committee and our senior management have ensured that our Board is deeply involved in the oversight of the company’s AI strategy, as well as any emerging issues that may arise at the cutting-edge of AI development, from protecting the safety and privacy of users, to our longstanding commitment to human rights, to developing ways to accelerate climate action.

Across all matters related to the company, we work closely with our investor relations and legal teams to understand investor perspectives. We value the input and support of all of Alphabet’s stakeholders, including our employees, users, partners, and stockholders, which have fueled the company’s immense contributions to making technology and information more accessible for all. Our Board deeply values these perspectives, which are so important to the strong future we see for Alphabet.

On behalf of my fellow directors, as we move through this next momentous turning point in AI, we could not be more grateful for your trust in us to oversee Alphabet’s work to deliver on its important mission.

Very truly yours,

John L. Hennessy

Chair of the Board of Directors

Alphabet 2024 Proxy Statement 3

Date and Time FRIDAY, JUNE 7, 2024 | Virtual Meeting Site www.virtualshareholdermeeting.com/GOOGL24 | Who Can Vote Alphabet stockholders of Class A or Class B |

| Items of Business | Alphabet Board Voting Recommendation | |||

| 1. | Election of Directors: Larry Page, Sergey Brin, Sundar Pichai, John L. Hennessy, Frances H. Arnold, R. Martin “Marty” Chávez, L. John Doerr, Roger W. Ferguson Jr., K. Ram Shriram, and Robin L. Washington |  | FOR each of the nominees | |

| 2. | Ratification of appointment of Ernst & Young LLP as Alphabet’s independent registered publicaccounting firm for the fiscal year ending December 31, |  | FOR | |

| 3. | Stockholder proposals, if properly presented |  | AGAINST | |

And to consider such other business as may properly come before the Annual Meeting and any postponements or adjournments thereof.

By order of the Board of Directors,

|  |

| Sundar Pichai | John L. Hennessy |

| Chief Executive Officer | Chair of the Board of Directors |

Review Your Proxy Statement and Vote In One Of Four Ways:

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker, or other holder of record to see which voting methods are available to you.

| Online Vote your shares at www.proxyvote.com. Have your Notice, voting instruction form, or proxy card for the 16-digit control number needed to vote. | |||

Annual Meeting |  | By Telephone Call toll-free number 1-800-690-6903. | ||

| By Mail Sign, date, and return your proxy card in | |||

| During the Annual Meeting |  | |||

Online See page 108 for details on voting | ||||

www.virtualshareholdermeeting.com/GOOGL24. |

|  | ||

This noticeNotice of 2024 Annual Meeting andof Stockholders, proxy statement, and form of proxy card are being distributed and made available on or about April 29 , 2016.26, 2024.

This proxy statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our investment and ongoing development of AI, our environmental, social, and governance goals, commitments, and strategies, and our executive compensation program. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our most recently filed periodic report on Form 10-K. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, which speak as of the respective date of this proxy statement, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

In this proxy statement, the words “Alphabet,” “the company,the “company,” “we,” “our,” “ours,” “us”“us,” and similar terms refer to Alphabet Inc. and its consolidated subsidiaries, unless the context indicates otherwise, and the word “Google” refers to Google Inc.,LLC, a wholly owned subsidiary of Alphabet.

ALPHABET INC. | 2016Alphabet 2024 Proxy Statement 4

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

This proxy statement and our 20152023 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2015,2023, are available at https://abc.xyz/investor/other/annual-meeting.html.annual-meeting/.

INCORPORATION BY REFERENCE

To the extent that this proxy statement has been or will be specifically incorporated by reference into any other filing of Alphabet under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (Exchange Act), the sections of this proxy statement titled “Report of the Audit and Compliance Committee of the Board of Directors” (to the extent permitted by the rules of the U.S. Securities and Exchange Commission (SEC)) and ��Executive, “Executive Compensation—Leadership Development, Inclusion and Compensation Committee Report” and “Executive Compensation—Alphabet Pay vs. Performance” shall not be deemed to be so incorporated, unless specifically stated otherwise in such filing.

ALPHABET INC. | 2016This proxy statement includes a number of references to websites, website addresses, and additional materials, including reports and blogs, found on those websites. The content of any websites and materials named, hyperlinked, or otherwise referenced in this proxy statement are not incorporated by reference into this proxy statement on Schedule 14A or in any other report or document we file with the SEC, and any references to such websites and materials are intended to be inactive textual references only.

Alphabet 2024 Proxy Statement 5

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

2016 PROXY STATEMENT SUMMARY

This summarysection highlights selected information contained elsewhere in this proxy statement. This summaryand does not contain all of the information that you should consider and youbefore voting. You should read the entire proxy statement carefully before voting.

2023 was a year of profound innovation and product momentum, as we aimed to deliver advanced, safe, and responsible AI. Powered by our continued investment in AI technology and infrastructure, we were able to bring new advances in generative AI to our core products including Search, YouTube, Gmail, Ads, Google Cloud and more. In December, we launched Gemini, our most capable and general model, which, along with other AI models we have previously developed, we now leverage across our business to deliver helpful products and services for our users, advertisers, partners, customers, and developers. As we pursue the opportunities ahead, we continue to focus on investing for the long term and with discipline to support this new wave of growth in AI-powered experiences.

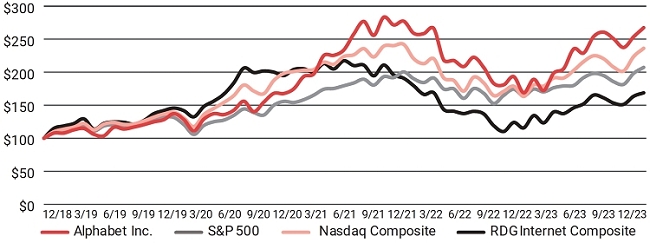

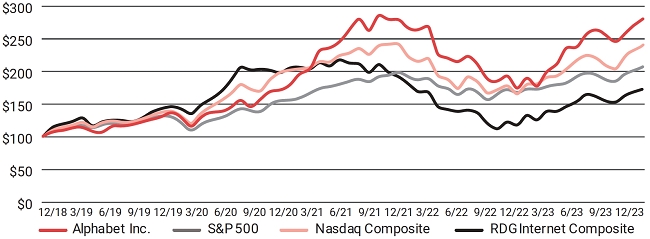

On August 10, 2015, Google announced plansThe following graphs match our Class A and Class C’s cumulative 5-year total stockholder returns on common stock and capital stock, respectively, with the cumulative total returns of the S&P 500 index, the Nasdaq Composite index, and the RDG Internet Composite index. The graphs track the performance of a $100 investment in our common stock and capital stock, respectively, and in each index (with the reinvestment of all dividends) from December 31, 2018 to create a new public holding company, Alphabet, by implementing a holding company reorganization (the “Reorganization”). On October 2, 2015, Google implemented the Reorganization, which resulted in Alphabet becoming the successor issuerDecember 31, 2023. The returns shown are based on historical results and are not intended to Google.suggest future performance.

Annual MeetingComparison of StockholdersCumulative 5-Year Total Return*

Alphabet Inc. Class A Common Stock

Among Alphabet Inc., the S&P 500 Index, the Nasdaq Composite Index, and the RDG Internet Composite Index

ALPHABET INC.Comparison of Cumulative 5-Year Total Return*

Alphabet Inc. Class C Capital Stock | 2016

Among Alphabet Inc., the S&P 500 Index, the Nasdaq Composite Index, and the RDG Internet Composite Index

*$100 invested on December 31, 2018 in stock or index, including reinvestment of dividends.

Copyright© 2024 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

Alphabet 2024 Proxy Statement 6

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

Voting Matters

Our Board believes that having a mix of directors with complementary qualifications, expertise, experience, backgrounds, and attributes is essential to meeting its multifaceted oversight responsibilities, representing the best interests of our stockholders, and providing practical insights and diverse perspectives.

| Alphabet Board | ||||||

| Voting | Page Reference | |||||

| Proposal | Recommendation | (for more detail) | ||||

| Management Proposals: | ||||||

| (1) | Election of eleven directors | FOR each nominee | 45 | |||

| (2) | Ratification of the appointment of Ernst & Young LLP as Alphabet’s independent registered public accounting firm for the fiscal year ending December 31, 2016 | FOR | 46 | |||

| (3) | A mendment s to Alphabet’s 2012 Stock Plan to increase the share reserve by 11,500,000 shares of Class C capital stock and to cap the aggregate amounts of stock-based and cash-based awards which may be granted under Alphabet’s 2012 Stock Plan to any non-employee member of the Board of Directors in respect of any calendar year, solely with respect to his or her service as a member of the Board of Directors, at $1,500,000. | FOR | 47 | |||

| (4) | An amendment to the Fourth Amended and Restated Certificate of Incorporation of Google to remove a provision that requires the vote of the stockholders of Alphabet, in addition to the vote of Alphabet (as sole stockholder), in order for Google to take certain actions | FOR | 53 | |||

| Stockholder Proposals: | ||||||

| (5) | Stockholder proposal regarding equal shareholder voting | AGAINST | 56 | |||

| (6) | Stockholder proposal regarding a lobbying report | AGAINST | 58 | |||

| (7) | Stockholder proposal regarding a political contributions report | AGAINST | 60 | |||

| (8) | Stockholder proposal regarding the adoption of a majority vote standard for the election of directors | AGAINST | 62 | |||

| (9) | Stockholder proposal regarding an independent chairman of the board policy | AGAINST | 64 | |||

| (10) | Stockholder proposal regarding a report on gender pay | AGAINST | 66 | |||

| 70% | Independent | 60% | Directors self-identify as female or from an underrepresented community |

|  | |

| Directors with a significant background in technology, including through experience in technology-related businesses, academic and research institutions, bring critical understanding of our industry and the technological trends and innovation that shape our products, services, and AI-first strategy | Directors with experience in, and exposure to, operating within complex business environments and diverse markets, engaging with international stakeholders, and navigating global regulatory regimes and frameworks, enhance our Board’s oversight of Alphabet’s global operations, supply chains, and strategic execution | |

|  | |

| Directors with professional experience in the financial sector, including through management of a financial firm or enterprise, contribute to our Board’s understanding of financial markets and to effective oversight of our capital structure, financial reporting, and financial activities, including our R&D investments | Directors with experience serving on nonprofit boards bring insight into overseeing and leading mission-driven organizations, foundations, and strategies for building successful partnerships with different customers and stakeholders, along with a nuanced perspective on ways in which our products, services and operations can make a positive impact on the communities we serve and operate within | |

| ||

| Leadership experience, including through service in public and private company executive roles or leadership of significant academic and other institutions, provides our Board with a deep understanding of organizational dynamics, complex operations, risk management, human capital and talent management, and other areas that are critical to overseeing a large global company and advancing our strategy | ||

ALPHABET INC. | 2016Alphabet 2024 Proxy Statement 7

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

Director Nominees

The following table provides summary information about each director nominee as of April 11, 2016.9, 2024.

| Membership on | ||||||||||||||||||

| Director | Experience/ | Standing Committees | ||||||||||||||||

| Name | Age | Since | Occupation | Qualification | Independent | AC | LDCC | NCGC | EC | |||||||||

| Larry Page | 43 | 1998 | Chief Executive Officer, Alphabet, Co-Founder and Director | Leadership, Technology | X | |||||||||||||

| Sergey Brin | 42 | 1998 | President, Alphabet, Co-Founder and Director | Leadership, Technology | X | |||||||||||||

| Eric E. Schmidt | 60 | 2001 | Executive Chairman of the Board of Directors of Alphabet | Leadership, Technology | C | |||||||||||||

| L. John Doerr | 64 | 1999 | General Partner of Kleiner Perkins Caufield &Byers | Leadership, Technology, Finance, Global, Industry | X | X | ||||||||||||

| Diane B. Greene | 60 | 2012 | Senior Vice President, Google, Former Chief Executive Officer and President of VMware | Leadership, Technology, Finance | ||||||||||||||

| John L. Hennessy | 63 | 2004 | President of Stanford University | Leadership, Education, Technology | X,L | C | ||||||||||||

| Ann Mather | 56 | 2005 | Former Chief Financial Officer of Pixar | Leadership, Finance | X | C,F | ||||||||||||

| Alan R. Mulally | 70 | 2014 | Former Chief Executive Officer and President of Ford | Leadership, Finance, Global, Industry | X | X | ||||||||||||

| Paul S. Otellini | 65 | 2004 | Former Chief Executive Officer andPresident of Intel | Leadership, Technology, Global, Industry | X | C | ||||||||||||

| K. Ram Shriram | 59 | 1998 | Managing Partner of SherpaloVentures | Leadership, Technology, Finance, Global, Industry | X | X | ||||||||||||

| Shirley M. Tilghman | 69 | 2005 | Former President of Princeton University | Leadership, Education | X | X | ||||||||||||

| Director | Membership on Standing Committees | Other Public | ||||||||||||||

| Name | Age | Since | Independent | ACC | LDICC | NCGC | EC | Boards(1) | ||||||||

| Larry Page Co-Founder | 51 | 1998 |  | 0 | ||||||||||||

| Sergey Brin Co-Founder | 50 | 1998 |  | 0 | ||||||||||||

| Sundar Pichai Chief Executive Officer, Alphabet and Google | 51 | 2017 |  | 0 | ||||||||||||

| John L. Hennessy (Chair) Former President of Stanford University | 71 | 2004 |  |  | 0 | |||||||||||

| Frances H. Arnold Linus Pauling Professor of Chemical Engineering, Bioengineering and Biochemistry at California Institute of Technology | 67 | 2019 |  |  | 1 | |||||||||||

| R. Martin “Marty” Chávez Partner and Vice Chairman of Sixth Street Partners | 60 | 2022 |  |  | 1 | |||||||||||

| L. John Doerr General Partner and Chairman of Kleiner Perkins | 72 | 1999 |  |  | 1 | |||||||||||

| Roger W. Ferguson Jr. Former President and Chief Executive Officer of TIAA | 72 | 2016 |  |  (2) (2) | 2 | |||||||||||

| K. Ram Shriram Managing Partner of Sherpalo Ventures | 67 | 1998 |  |  | 1 | |||||||||||

| Robin L. Washington Former Executive Vice President and Chief Financial Officer of Gilead Sciences | 61 | 2019 |  |  (3) (3) |  | 3 | ||||||||||

| Audit and Compliance Committee | ||||||

| Leadership Development, Inclusion and Compensation Committee | ||||||

| NCGC – | Nominating and Corporate Governance Committee | |||||

| EC – | Executive Committee | |||||

– – | Committee Chair | |||||

| Audit Committee Financial Expert |

| (1) | Alphabet’s Corporate Governance Guidelines provide that the maximum number of public company boards our directors can serve on is four, including membership on the Alphabet Board. All nominees are in compliance with this policy. |

| (2) | Roger was appointed as the Chair of the Audit and Compliance Committee effective October 31, 2023. |

| (3) | Robin was appointed as a member of the Audit and Compliance Committee effective October 31, 2023. |

Alphabet 2024 Proxy Statement 8

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

Our corporate governance structure is designed to promote long-term stockholder value creation through the leadership and oversight provided by our thoughtfully and effectively composed Board. Our Board is committed to maintaining alignment with stockholder interests through our strong governance practices and by seeking and incorporating stockholder feedback that informs key areas of focus for our Board and the company each year.

| Board Leadership and Composition | Board and Committee Practices | Stockholder Alignment | ||||

• Independent Chair of the Board, separate from CEO role • 100% independent key committees (ACC, LDICC, NCGC) and committee chairs • Review of each committee chair at least every three years • Board membership criteria established by the Board with consideration of potential director nominee’s integrity, strength of character, judgment, business experience, specific areas of expertise and knowledge of the industries in which the company operates, ability to devote sufficient time to attendance at and preparation for Board meetings, factors relating to Board composition, and principles of diversity • Diverse Board in terms of race, ethnicity, gender, age, education, skills, cultural background, professional experiences, and tenure • Commitment to consider underrepresented people of color and different genders as potential director nominees | • Annual Board and committee evaluations • Executive sessions of independent directors for all quarterly Board and committee meetings led by the Chair of the Board and committee chairs, respectively • Director commitment policy, which provides that the maximum number of public company boards directors can serve on is four (including Alphabet Board) • Director orientation and continuing education programs • Committee meetings open to all directors | • Annual election for all directors • Majority voting standard for election of directors • Removal of directors with or without cause • Minimum stock ownership requirements for both executive officers and directors • Channels for stockholder feedback, including via engagements • Board oversight and evaluation of stockholder proposals submitted for consideration at the annual meeting of stockholders • Commitment for the Board to represent the balanced, best interests of the stockholders as a whole rather than special interest groups or constituencies | ||||

Each director nominee serves as a current directorFor more detailed information on Alphabet’s corporate governance and attended at least 75% of all meetings of therisk oversight framework, see “Directors, Executive Officers, and Corporate Governance—Corporate Governance and Board of Directors, and each committeeMatters” beginning on which she or he sat during 2015. Note that all meetings prior to October 2, 2015 were that of Google’s Board of Directors and its committees. Diane B. Greene resigned from the Audit Committee on December 16, 2015. L. John Doerr resigned from the LDCC and joined the Audit Committee on December 17, 2015.page 28.

Auditors

We are askingproactively engage with our stockholders to ratifyand other stakeholders throughout the appointmentyear on a broad range of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. Set forth below is summary information with respecttopics that are of interest and priority to the fees paid or accrued by us for the auditcompany and our stockholders. These include business strategy and performance, corporate governance, executive compensation, and environmental sustainability, among other services provided by Ernst & Young LLP during 2014 and 2015 (in thousands).matters.

| 2014 ($) | 2015 ($) | |||||||

| Audit Fees | 13,865 | 13,820 | ||||||

| Audit-Related Fees | 1,742 | 3,572 | ||||||

| Tax Fees | 5,180 | 3,282 | ||||||

| Other Fees | 72 | 6 | ||||||

| Total Fees | 20,859 | 20,680 | ||||||

Our engagement enables us to better understand our stockholders’ priorities and perspectives, gives us an opportunity to elaborate on our initiatives, policies, and practices, and fosters open and constructive dialogue. We share the feedback from these conversations with our Board, which considers these perspectives as part of its evaluation and review of our practices and disclosures.

ALPHABET INC. | 2016Alphabet 2024 Proxy Statement 9

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

At Alphabet, we aim to build technology to help improve the lives of Contentsas many people as possible. In pursuing this goal, we develop products and services that we believe have a positive impact on the world and further the long-term interests of our business, stockholders, and stakeholders.

Our Board and its committees provide oversight of environmental, social, and governance matters. At the committee level, oversight of specific environmental, social, and governance topics is assigned to the relevant committees, including:

ALPHABET INC. | 2016The scale and breadth of our products, services, and operations provide us both an opportunity and a responsibility to manage the company in a responsible way. We have a long track record of transparency, and we are proud of the leadership role the company has played in advancing disclosures on important issues. For example:

| • | In 2010, we were one of the first in our industry to issue annual Transparency Reports, which share data on how we handle content that violates our policies, as well as how we handle government requests for removal content. |

| • | We were also one of the first technology companies to publish workforce diversity metrics beginning in 2014. |

| • | In 2018, we were one of the first companies to commit to AI Principles that put beneficial use, users, safety, and avoidance of harms above business considerations, and we have pioneered many best practices. |

| • | Also in 2018, we launched a quarterly YouTube Community Guidelines Enforcement Report, which we have expanded and refined over the years to include additional data. |

| • | We maintain and disclose an Index that maps our public disclosures to the Sustainable Accounting Standards Board (SASB) and to the Task Force on Climate-Related Financial Disclosures (TCFD) frameworks. |

Alphabet 2024 Proxy Statement 10

Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

In addition, we provide extensive reporting and transparency across a broad range of topics and constantly evolve our disclosures to align with best practices and expectations. Some of our key reports include:

• Environmental Report • CDP Climate Change Response • Expressing our support for TCFD • Accelerating Climate Action with AI • Visit our Sustainability website for additional reports • Learn more about our efforts in our Sustainability blog | |||

► Security and Privacy reports ► Content removal reports • Ads Safety Report • Google Privacy Policy • Google Safety Center • Learn more about our efforts in our Safety & Security blog | |||

• EEO-1 Report • Visit our Belonging website for additional reports • Learn more about our efforts in our Diversity blog | |||

ALPHABET INC. | 2016

Alphabet 2024 Proxy Statement 11

Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Proxy MaterialsWe describe here our transparency and oversight efforts across selected environmental and social topics that we believe are of interest to many of our stockholders and broader stakeholders:

We care deeply about sustainability, and we strive to build it into everything we do. Oversight of environmental sustainability primarily resides with our Audit and Compliance Committee. The Audit and Compliance Committee reviews and discusses with management our risk exposures, including those related to environmental sustainability, and the steps that we take to detect, monitor and actively manage such exposures. In 2022, we evolved our approach to sustainability governance by creating a Sustainability Focus Area, an internal team led by our SVP of Learning and Sustainability that provides centralized management oversight of sustainability and climate-related issues. We track and provide transparent information and data on our environmental sustainability initiatives. Please see our annual environmental report, our CDP climate change response, our Sustainability website, and our Sustainability blog for more information on our actions and progress. | ||

Content Governance, Data | Ensuring proper use of our platforms and protecting the data privacy and security of our users is fundamental to maintaining our users’ trust and to ensuring our long-term business success. Our Audit and Compliance Committee has specific oversight of data privacy and security matters. We are committed to promoting transparency and provide detailed reporting at the company level and, where applicable, individual business level regarding our policies, programs, and performance including: • Our Transparency Report, which shares data on how we handle content that violates our policies, as well as how we handle government requests for removal of content. • Our Ads Safety Report, where we explain how we are using evolving policies and better technology to find and remove policy-violating ads. • Our YouTube enforcement report, which we release on a quarterly basis, includes information on channel removals, removal of comments, the policy reasons for removals, and data on appeals. Please see our Google Transparency Report website for a comprehensive list of transparency reports on Security and Privacy, Content Removals, and additional reports. | |

| Diversity & Belonging: | We report on our commitments, initiatives, and progress through our Diversity Annual Report and also share publicly our Equal Employment Opportunity Report (EEO-1). Our Leadership Development, Inclusion and Compensation Committee has specific oversight of human capital management, including our diversity and belonging efforts. Please see our Belonging website for more information. | |

| Human Rights: | At Alphabet, we are guided by internationally recognized human rights standards. We have a longstanding commitment to respecting the rights enshrined in the Universal Declaration of Human Rights and its implementing treaties, as well as to upholding the standards established in the United Nations Guiding Principles on Business and Human Rights and in the Global Network Initiative Principles. Under the umbrella of our Human Rights Program, management oversees the implementation of our civil rights and human rights work and provides relevant updates to our Audit and Compliance Committee. Responsibility for oversight of human rights issues is specifically codified in the Audit and Compliance Committee Charter. Our Human Rights website provides details on our commitments and outlines our approach to human rights. |

Alphabet 2024 Proxy Statement 12

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

| Public Policy and Lobbying: | Our engagement with policymakers and regulators is guided by a commitment to ensuring our participation is always open, transparent, and clear to our users, stockholders, and the public. Our Nominating and Corporate Governance Committee and senior management review our corporate political policies and activities to ensure appropriate policies and practices are in place and serving the interests of our stockholders. Our lobbying, trade association, and political engagement policies and disclosures are the result of careful ongoing consideration and analysis by our management. Our U.S. Public Policy Transparency website and our EU Public Policy Principles website provides robust and regularly updated disclosures on our public policy and lobbying activities, trade association participation, and other key elements of our approach to policy engagement. | |

| Responsible AI: | As an information and computer science company, we aim to and have been at the forefront of advancing the frontier of AI through our path-breaking and field-defining research to develop more capable and useful AI. Oversight of risks and exposures associated with AI is effectively carried out at both our Board and Audit and Compliance Committee levels. Given AI’s importance and prominence for our business, it has been a long-standing topic that is regularly and extensively covered at our full Board meetings. Our Board receives regular reports and updates from our senior management (in addition to what the Audit and Compliance Committee receives from our senior management) who are immersed, on a daily basis, in the implementation of our AI Principles that are designed to provide safe, secure, and trustworthy AI development across products. These reports and regular discussions ensure that our Board is fully involved in the oversight of the company’s business strategies and plans as they relate to AI, as well as any issues that may arise that may impact the company’s risk exposures. We have been incorporating AI into our products and services for more than two decades. We believe it is important to consider the consequences and impact of a new technology before releasing it, and we have been transparent about the implementation of our AI Principles, which guide our bold and responsible approach to AI. In 2018, we were one of the first companies to commit to AI Principles, and since 2019, we have provided consistent transparency of how we put them into practice in our annual AI Principles Updates. We provide more information on our AI approach, responsibilities, and principles on our annual AI Principles Updates, our AI website, and our AI blog. |

Alphabet 2024 Proxy Statement 13

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

We design our executive officer compensation programs to attract and retain the world’s best talent, support Alphabet’s culture of Directors has made these materials available to youinnovation and performance, and align employee and stockholder interests.

| Sound Program Design | Pay for Performance | Best Practices in Executive Compensation | ||||

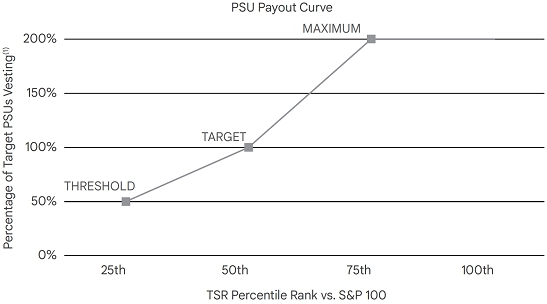

• Competitive total pay opportunity to attract, retain, and motivate leaders • Primarily equity-based compensation with payout aligned to long-term company performance • Multi-year vesting of stock awards • Continuous risk oversight and compensation design features that safeguard against excessive risk taking • Independent compensation consultants who provide guidance on compensation design and risk assessment | • Performance stock awards with payout based on long-term company performance • Performance stock awards include total shareholder return modifier to reward significant positive outperformance of Alphabet relative to the companies comprising the S&P 100 for the applicable performance period | • No change in control benefits • Prohibition of pledging and hedging ownership of Alphabet stock by executive officers, directors, and employees • No executive-only benefit plans or retirement programs • No excessive perquisites | ||||

For more detailed information on the Internet, or, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies for use at Alphabet’s 2016 executive compensation philosophy and practices, see “Compensation Discussion and Analysis” beginning on page 46.

Alphabet 2024 Proxy Statement 14

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

Time and Date: 9:00 a.m., Pacific Time, on |

Virtual Meeting Access: Alphabet stockholders (or their proxy holders) can participate in and vote at our Annual Meeting by visiting | ||

Record Date: April 9, 2024 | |||

Voting: Holders of the close of business on April 11, 2016, the Record Date for the Annual Meeting, or hold a valid proxy for the Annual Meeting. As of October 2, 2015, Alphabet became the successor issuer to, and parent holding company of, Google pursuant to a holding company reorganization in which all of Google’s outstanding shares were automatically converted into equivalent corresponding shares of Alphabet. If you are a holder of Alphabet Class A or Class B common stock as of the Record Date you are requestedentitled to vote. Each share of Class A common stock is entitled to one (1) vote with respect to each director nominee and one (1) vote with respect to each of the proposals to be voted on. Each share of Class B common stock is entitled to ten (10) votes with respect to each director nominee and ten (10) votes with respect to each of the proposals to be voted on. The holders of the shares of Class A common stock and Class B common stock are voting as a single class on theall matters. Holders of Class C capital stock have no voting power as to any items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under the U.S. Securities and Exchange Commission (SEC) rules and that is designed to assist you in voting your shares.

The proxy materials include:

The information in this proxy statement relates to the proposals towill be voted on at the Annual Meeting.

Participating in the Annual Meeting: We have adopted a virtual format for our Annual Meeting to expand convenient access to, and make participation accessible for, stockholders from any geographic location with internet connectivity. We believe the virtual format encourages attendance and participation by a broader group of stockholders, while also reducing the cost and environmental impact associated with meetings held in-person.

You are entitled to participate in the Annual Meeting if you were a holder of Class A or Class B common stock as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/GOOGL24, you must enter the 16-digit control number found in the box marked by the arrow for postal mail recipients of the Notice, voting process,instruction form, or the compensationproxy card, or within the body of our directors and certain of our executive officers, corporate governance, and certain other required information.the email for electronic delivery recipients.

We encourage you to access the Annual Meeting before it begins. Online check-in will start approximately 30 minutes before the Annual Meeting on June 7, 2024. If you have difficulty accessing the meeting, please call 1-844-986-0822 (toll free) or 1-303-562-9302 (international). We will have technicians available to assist you.

the Meeting |  | Online Vote your shares at www.proxyvote.com. Have your Notice, voting instruction form, or proxy card for the | ||

| By Telephone Call toll-free number 1-800-690-6903. | |||

| By Mail Sign, date, and return the | |||

| Vote Online During the Meeting |  | Online See page 108 for details on voting your shares during the Annual Meeting through |

In accordance with rules adopted by the SEC, we may furnish proxy materials, including this proxy statement and our Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (Notice), which was mailed to most of our stockholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

ALPHABET INC. | 2016Alphabet 2024 Proxy Statement 115

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice

|  |  Board Voting Recommendation | Rationale | |

| Management Proposals: | ||||

1 | ||||

FOR | • Slate of highly qualified director nominees with broad and diverse backgrounds, experiences, and skill sets aligned to Alphabet’s unique and evolving business | |||

Stockholders who hold shares in street name (as described below) may contact their brokerage firm, bank, broker-dealer, or other similar organization to request information about householding.

2

The Notice, proxy card or voting instruction form will contain instructions on how to:

Our proxy materials are also available on our Investor Relations website at https://abc.xyz/investor/other/annual-meeting.html.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you revoke it.

ALPHABET INC. | 2016 Proxy Statement 2

The items of business scheduled to be voted on at the Annual Meeting are:

FOR | • Ernst & Young LLP is an independent accounting firm with the breadth of expertise and knowledge necessary to effectively audit Alphabet’s financial statements • All audit and non-audit services provided by Ernst & Young LLP are pre-approved by our Audit and Compliance Committee | |||||

| Stockholder Proposals: | ||||||

3 |

AGAINST | • The • Our director compensation, which has a maximum limit, is determined through a fair and collaborative process and is designed to align director and stockholder interests | ||||

4 Stockholder proposal regarding an EEO policy risk report (page 71) |

AGAINST | • Our commitment to a respectful, safe, inclusive workplace, including a wide range of | ||||

5 |

AGAINST | • Our cellular devices meet all regulatory and safety requirements for countries where the products are sold, and we maintain transparency around the safety and regulatory information regarding use of Pixel devices • Current regulatory limits are backed by scientific research, which have concluded that long-term radiofrequency exposure below the exposure limits has not been established as causing any type of adverse health effects in humans | ||||

6 |

AGAINST | • We already have a robust governance framework, policies, and mechanisms in place to assess director nominees’ eligibility and qualifications to serve on our Board and manage any potential conflicts of interest • Given that mandating public disclosure of director nominees’ political and charitable giving is not common practice, and that many people prefer to make philanthropic contributions anonymously, the requested policy may deter otherwise qualified individuals from serving on our Board |

Alphabet 2024 Proxy Statement 16

| Proxy Statement Summary & Highlights | Corporate Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

| Proposal | Alphabet Board Voting Recommendation | Rationale | ||

7 Stockholder proposal regarding a report on climate risks to retirement plan beneficiaries (page 81) |

AGAINST | • Our 401(k) Plan participants are free to • Federal law requires that a | ||

8 |

AGAINST | • We already publish extensive lobbying disclosures, which address much of the information requested in the proposal • We have robust oversight mechanisms in place, including oversight by our Board and senior management team | ||

9 Stockholder proposal regarding equal shareholder voting (page 87) |

AGAINST | • Our strong governance practices and current capital structure have provided significant long-term stability to the company and have proven beneficial to stockholders through the delivery of exceptional returns over the life of the company | ||

10 Stockholder proposal regarding a report on reproductive healthcare misinformation risks (page 90) |

AGAINST | • We have clear and longstanding policies that govern abortion-related advertising on our platforms and are compliant with local laws and regulations to enable informed healthcare decisions • We continually strive to protect our users from misleading content, including through our policies governing health content in advertisements and other products | ||

11 Stockholder proposal regarding AI principles and Board oversight (page 93) |

AGAINST | • Oversight of risks and exposures associated with AI is already being effectively carried out at both our full Board and Audit and Compliance Committee levels • Explicitly calling out AI in the Audit and Compliance Committee Charter is unnecessary as it is already subsumed within the broader risk assessment areas set forth in its Charter and would provide no incremental benefit to our stockholders | ||

12 |

AGAINST | • Our enterprise risk frameworks, product policies, and tools provide a foundation for identifying and mitigating AI-generated mis/disinformation and other potential risks • We continually strive to improve the quality of our generative AI models and applications through both pre-launch testing and ongoing fine-tuning, and we are transparent about our ongoing work via public reporting | ||

13 Stockholder proposal regarding a human rights assessment of AI-driven targeted ad policies (page 99) |

AGAINST | • Our human rights governance and management structure provides effective oversight of key human rights risks and mitigation strategies • We have progressed solutions that are built based on privacy enhancing technologies to address concerns similar to those raised in this proposal | ||

14 Stockholder proposal regarding a report on online safety for children (page 102) |

AGAINST | • We build child-appropriate features directly into our products and provide extensive information about our child policies and enforcement efforts • Most, if not all, of the recent regulatory frameworks include robust reporting requirements — as such, we already provide child safety-related metrics that are more substantive and informative in nature than the type of report requested in this proposal |

Alphabet 2024 Proxy Statement 17

We will also consider any other business that properly comes before the Annual Meeting. See Question 21 below.

Our Board of Directors recommends that you vote your shares:

ALPHABET INC. | 2016Alphabet 2024 Proxy Statement 318

Each share of Alphabet Class A common stock and Class B common stock issued and outstanding as of the close of business on April 11, 2016, the Record Date for the Annual Meeting, is entitled to be voted on all items being voted on at the Annual Meeting. Holders of Alphabet Class C capital stock have no voting power as to any items of business that will be voted on at the Annual Meeting. You may vote all shares of Alphabet Class A common stock and Class B common stock that you owned as of the Record Date, including shares held (1) directly in your name as the stockholder of record, and (2) for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee. On the Record Date, we had shares of Class A common stock and Class B common stock issued and outstanding, consisting of shares of Class A common stock and shares of Class B common stock. On the Record Date, we had shares of Class C capital stock issued and outstanding.

Each holder of shares of Alphabet Class A common stock is entitled to one vote for each share of Class A common stock held as of the Record Date, and each holder of shares of Alphabet Class B common stock is entitled to ten votes for each share of Class B common stock held as of the Record Date. The holders of the shares of Alphabet Class A common stock and Class B common stock are voting as a single class on all matters described in this proxy statement for which your vote is being solicited.

Most Alphabet stockholders hold their shares as a beneficial owner through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

| 112 | ||||

You may vote your shares held in your name as the stockholder of record in person at the Annual Meeting. You may vote your shares held beneficially in street name in person at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

ALPHABET INC. | 2016Alphabet 2024 Proxy Statement 419

Summary & Highlights | Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

Whether you hold shares directly

Our Board of Directors (our Board) is composed of highly experienced and diverse directors who have led, advised, and established leading global organizations and institutions. Our Board has taken a thoughtful approach to board composition to ensure that our directors have backgrounds that collectively add significant value to the strategic decisions made by the company and that enable them to provide oversight of management to ensure accountability to our stockholders. Our Board has endeavored to strike the right balance between long-term understanding of our business and fresh external perspectives, adding three new directors in the past five years, as well as ensuring the stockholderdiversity of record or beneficially in street name, you may direct how your shares are voted without attendingbackgrounds and perspectives within the Annual Meeting.boardroom.

If you are a stockholderOur directors have extensive backgrounds as entrepreneurs, technologists, operational and financial experts, academics, scientists, investors, advisors, nonprofit board members, and government leaders — all of record, you may vote by proxy. You can vote by proxy overwhich provide skills and expertise directly relevant to our strategic and oversight priorities. Many of the Internet by following the instructions providedcurrent directors have senior leadership experience at major domestic and international companies. In these positions, they have also gained experience in the Notice,core management skills, such as strategic and financial planning, public company financial reporting, compliance, risk management, leadership development, and international business experience. Most of our directors also have experience serving on boards of directors and board committees of other public companies, and have an understanding of corporate governance practices and trends, different business processes, challenges, and strategies. Other directors have experience as presidents or if you requestedtrustees of significant academic, research, and philanthropic institutions, which brings unique perspectives in relevant disciplines and institutional leadership to receive printed proxy materials, you canour Board. Further, our directors also vote by mailhave other experience that makes them valuable members, such as entrepreneurial experience and experience developing technology or telephone pursuant to instructions provided on the proxy card.managing technology companies, which provides insight into strategic and operational issues we face.

If you hold shares beneficially in street name, you may also voteThe demographic information presented below for our directors is based on voluntary self-identification by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by telephone or mail by following the voting instruction form provided to you by your broker, bank, trustee, or nominee.each director as of April 9, 2024. Additional biographical information of our directors and executive officers as of April 9, 2024 is set forth starting on page 21.

If you are the stockholder of record, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by:Board Diversity Matrix

|  |  |  |  |  |  |  |  |  | |

| Gender Identity | ||||||||||

| Male |  |  |  |  |  |  |  |  | ||

| Female |  |  | ||||||||

| Race/Ethnicity | ||||||||||

| African American or Black |

If you hold shares beneficially in street name, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by:

|  | |||||||||

| Asian |  |  | ||||||||

| Hispanic |  | |||||||||

| White |  |  |  |  |  | |||||

| LGBTQ+ |  |

Note that for both stockholders of record and beneficial owners, attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote in person at the Annual Meeting.

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Alphabet or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide on their proxy card written comments, which are then forwarded to Alphabet management.

The quorum requirement for holding the Annual Meeting and transacting business is that holders of a majority of the voting power of Alphabet’s shares of Class A common stock and Class B common stock outstanding as of the Record Date must be present in person or represented by proxy. Both abstentions and broker non-votes (described below) are counted for the purpose of determining the presence of a quorum.

ALPHABET INC. | 2016 2024 Proxy Statement 520

Summary & Highlights | Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

| Larry Page Co-Founder Director since 1998 | Executive Committee (Chair) | |||

Selected Membership: • The Carl Victor Page Memorial Foundation | Larry Page, 51, one of Google’s Co-Founders, previously served as Google’s Chief Executive Officer from April 2011 to October 2015, and as Alphabet’s Chief Executive Officer from October 2015 to December 2019. From July 2001 to April 2011, Larry served as Google’s President, Products. In addition, from September 1998 to July 2001, Larry served as Google’s Chief Executive Officer, and from September 1998 to July 2002, as Google’s Chief Financial Officer. Larry holds a Bachelor of Science degree in engineering, with a concentration in computer engineering, from the University of Michigan and a Master of Science degree in computer science from Stanford University. Select Leadership Skills and Additional Experiences: • Business leadership, operational experience, and experience developing technology as Co-Founder of Google and former Chief Executive Officer of Alphabet. • In-depth knowledge of the technology sector and experience in developing transformative business models. | ||

Sergey Brin Co-Founder Director since 1998 | Executive Committee | |||

Selected Membership: • The Sergey Brin Family Foundation | Sergey Brin, 50, one of Google’s Co-Founders, previously served as Google’s President from May 2011 to October 2015, and as Alphabet’s President from October 2015 to December 2019. From July 2001 to April 2011, Sergey served as Google’s President, Technology and Co-Founder. In addition, from September 1998 to July 2001, Sergey served as Google’s President and Chairman of Google’s Board of Directors. Sergey holds a Bachelor of Science degree with high honors in mathematics and computer science from the University of Maryland at College Park and a Master of Science degree in computer science from Stanford University. Select Leadership Skills and Additional Experiences: • Business leadership, operational experience, and experience developing technology as Co-Founder of Google and former President of Alphabet. • In-depth knowledge of the technology sector and experience in developing transformative business models. | ||

In the election of directors (Proposal Number 1), you may vote “FOR” all or some of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees.

For the other items of business, you may vote “FOR,” “AGAINST,” or “ABSTAIN.” If you elect to “ABSTAIN,” the abstention has the same effect as a vote “AGAINST.”

If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated on a properly executed proxy card or over the telephone or Internet, the shares will be voted as recommended by our Board of Directors.

In the election of directors, the eleven persons receiving the highest number of affirmative “FOR” votes at the Annual Meeting will be elected.

The approval of an amendment to Google’s Fourth Amended and Restated Certificate of Incorporation requires the affirmative “FOR” vote of the holders of at least sixty-six and two-thirds percent (66 2/3%) of the voting power of the issued and outstanding shares of Class A common stock and Class B common stock of Alphabet then entitled to vote thereon, voting together as a single class.

The approval of the remaining nine proposals described below requires the affirmative “FOR” vote of the holders of a majority of the voting power of Alphabet’s shares of Class A common stock and Class B common stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, voting together as a single class:

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. All of the matters scheduled to be voted on at the Annual Meeting are “non-routine,” except for the proposal to ratify the appointment of Ernst & Young LLP as Alphabet’s independent registered public accounting firm for the fiscal year ending December 31, 2016. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered voting power present with respect to that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained, other than Proposal Number 4 regarding the approval of an amendment to the Fourth Amended and Restated Certificate of Incorporation of Google, for which broker non-votes will count as a vote “AGAINST” such proposal.

Abstentions are considered voting power present at the Annual Meeting and thus will have the same effect as votes against each of the matters scheduled to be voted on at the Annual Meeting (other than the election of directors).

Please note that since brokers may not vote your shares on “non-routine” matters, including the election of directors (Proposal Number 1), the proposal to amend Alphabet’s 2012 Stock Plan (Proposal Number 3), the proposal to amend Google’s Fourth Amended and Restated Certificate of Incorporation (Proposal Number 4), and each of the stockholder proposals (Proposals Number 5 through Number 10), in the absence of your specific instructions, we encourage you to provide instructions to your broker regarding the voting of your shares.

ALPHABET INC. | 2016 2024 Proxy Statement 621

Summary & Highlights | Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

Sundar Pichai Chief Executive Officer, Alphabet and Google Director since 2017 | Executive Committee | |||

Selected Membership: • The Pichai Family Foundation | Sundar Pichai, 51, joined Google in 2004 and was named the Chief Executive Officer of Google in October 2015 and of Alphabet in December 2019. Sundar has led product and engineering for Google’s products and platforms, including Search, Chrome, Maps, Android, Gmail, and Google Workspace. Sundar served as Google’s Senior Vice President of Products from October 2014 to October 2015, and as Google’s Senior Vice President of Android, Chrome and Apps from March 2013 to October 2014. As CEO, he has shifted the Select Leadership Skills and Additional Experiences: • Business leadership, operational experience, and experience developing technology as Chief Executive Officer of Alphabet and Google. • In-depth knowledge of the technology sector, and experience in developing Alphabet and Google’s products and services and leading the company’s strategic vision, management, and operations. | ||

John L. Hennessy Chair of the Board Independent Director since 2004 | Nominating and Corporate Governance Committee (Chair) | |||

Selected Memberships: • Board of Trustees, Gordon and Betty Moore Foundation • Trustee, Queen Elizabeth Prize for Engineering Foundation | John L. Hennessy, 71, has served as Chair of our Board since January 2018. John previously served as our Lead Independent Director from April 2007 to January 2018. John is the James F. and Mary Lynn Gibbons Professor of Computer Science and Electrical Engineering in the Stanford School of Engineering, and the Shriram Family Director of Stanford’s Knight-Hennessy Scholars, a graduate-level scholarship program. John served as the President of Stanford University from September 2000 to August 2016. From 1994 to August 2000, John held various positions at Stanford, including Dean of the Stanford University School of Engineering and Chair of the Stanford University Department of Computer Science. John is the recipient of numerous honors, including the Medal of Honor of the Institute of Electrical and Electronics Engineers, and the ACM A.M. Turing Award. John holds a Bachelor of Science degree in electrical engineering from Villanova University and a Master of Science degree and a Doctoral degree in computer science from the State University of New York, Stony Brook. Select Leadership Skills and Additional Experiences: • Leadership and management experience as a former president of a world-renowned university. • Experience developing technology businesses as founder of MIPS Technologies, Inc. and chief architect of Silicon Graphics Computer Systems, Inc. • Global business perspective from his service on other boards. | ||

No, you may not cumulate your votes for the election of directors.

Alphabet will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. We have also retained Georgeson LLC to assist us in the distribution of proxy materials. We will pay Georgeson LLC a fee of approximately $1,000 plus reasonable out-of-pocket expenses for these services.

Other than the eleven items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Larry Page, Eric E. Schmidt, Ruth M. Porat, David C. Drummond, and Kent Walker, or any of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If, for any reason, any of the nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

We will announce preliminary voting results at the Annual Meeting and publish final voting results on the Investor Relations section of our website at https://abc.xyz/investor/other/annual-meeting.html. We will also disclose the final voting results in a Current Report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

You are entitled to attend the Annual Meeting only if you were a holder of Alphabet Class A or Class B common stock as of the Record Date or you hold a valid proxy for the Annual Meeting. Since seating is limited, admission to the Annual Meeting will be on a first-come, first-served basis. You must present valid photo identification, such as a driver’s license or passport, for admittance. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you must also provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to April 11, 2016, a copy of the voting instruction form provided by your broker, bank, trustee, or nominee, or other similar evidence of ownership.

If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting. For security reasons, you and your bags will be subject to search prior to your admittance to the Annual Meeting.

Please let us know if you plan to attend the Annual Meeting by marking the appropriate box on the enclosed proxy card, if you requested to receive printed proxy materials, or, if you vote by telephone or Internet, by indicating your plans when prompted.

The Annual Meeting will begin promptly at 9:00 a.m., local time. Check-in will begin at the Shoreline Amphitheatre at 7:30 a.m., local time, and you should allow ample time for the check-in procedures. The Shoreline Amphitheatre is located at 1 Amphitheatre Parkway, Mountain View, California 94043.

ALPHABET INC. | 2016 2024 Proxy Statement 722

Summary & Highlights | Governance | Director and Executive Compensation | Audit Matters | Proposals | Q&A |

For your convenience, we are pleased to offer a live webcast of our Annual Meeting at https://www.youtube.com/c/AlphabetIR.

Frances H. Arnold Independent Director since 2019 | Nominating and Corporate Governance Committee | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Public Company Directorship:

• Illumina, Inc.

Selected Memberships:

Alphabet 2024 Proxy Statement 25

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ruth M. Porat President and Chief Investment Officer; Chief Financial Officer, Alphabet and Google | |||||

Public Company Directorship: • Blackstone Inc. Selected Memberships and | |||||

• Board of Directors, | |||||

• Board of Trustees, Memorial Sloan Kettering Cancer Center • Board of Directors, Stanford Management Company • Board of Directors, Bloomberg Philanthropies | |||||

Ruth M. Porat, 66, has served as President and Chief Investment Officer of Alphabet and Google since September 2023 and as Senior Vice President, Chief Financial Officer of Google since May 2015 and | |||||

Select Leadership Skills and Additional Experiences: • Extensive financial and management expertise in the finance, investment, and technology industries. • Outside board experience and global business perspective from her service on other boards. | |||||

Prabhakar Raghavan Senior Vice President, Knowledge and Information, Google | |||||

Selected Memberships: • Member, National Academy of Engineering • Fellow, Association for Computing Machinery • Fellow, Institute of Electrical and Electronic Engineers (IEEE) | Prabhakar Raghavan, 63, has served as Senior Vice President of Google since November 2018. He is responsible for Google Search, Assistant, Geo, Ads, Commerce, and Payments products. Previously, he served as Senior Vice President, Ads, from October 2018 to June 2020, and as Vice President, Apps, from May 2014 to October 2018. Prior to joining Google in March 2012, Prabhakar founded and led Yahoo! Labs, served as the chief technology officer at Verity, held various positions over the course of fourteen years at IBM Research, and was a Consulting Professor of Computer Science at Stanford University. Prabhakar holds a Bachelor of Technology degree from the Indian Institute of Technology Madras and a Doctoral degree in electrical engineering and computer science from the University of California, Berkeley. Select Leadership Skills and Additional Experiences: • Extensive management experience having served in various leadership roles in several technology companies. • In-depth knowledge of the technology sector. | ||||

Larry Page, the Chief Executive Officer of Alphabet was one of Google’s founders and has served as a member of our Board of Directors since its inception in September 1998, and as Google’s Chief Executive Officer from April 2011 to October 2015 (when he became the Chief Executive Officer of Alphabet). From July 2001 to April 2011, Larry served as Google’s President, Products. In addition, from September 1998 to July 2001, Larry served as Google’s Chief Executive Officer, and from September 1998 to July 2002, as Google’s Chief Financial Officer. Larry holds a Master of Science degree in computer science from Stanford University and a Bachelor of Science degree in engineering, with a concentration in computer engineering, from the University of Michigan.

Sergey Brin, President of Alphabet, was one of Google’s founders and has served as a member of our Board of Directors since its inception in September 1998. Previously, Sergey served as Google’s President, Technology and Co-Founder. In addition, from September 1998 to July 2001, Sergey served as Google’s President and Chairman of Google’s Board of Directors. Sergey holds a Master of Science degree in computer science from Stanford University and a Bachelor of Science degree with high honors in mathematics and computer science from the University of Maryland at College Park.

Eric E. Schmidt, Executive Chairman of the Board of Directors of Alphabet, has served as the Executive Chairman of our Board of Directors since April 2011 and as a member of our Board of Directors since March 2001. From July 2001 to April 2011, Eric served as Google’s Chief Executive Officer. He was the chairman of Google’s Board of Directors from March 2001 to April 2004, and again from April 2007 to April 2011. Prior to joining Google, from April 1997 to November 2001, Eric served as chairman of the Board of Directors of Novell, Inc., a computer networking company, and, from April 1997 to July 2001, as the Chief Executive Officer of Novell. From 1983 until March 1997, Eric held various positions at Sun Microsystems, Inc., a supplier of network computing solutions, including Chief Technology Officer from February 1994 to March 1997, and President of Sun Technology Enterprises from February 1991 until February 1994. Eric holds a Doctoral degree and a Master of Science degree in computer science from the University of California, Berkeley, and a Bachelor of Science degree in electrical engineering from Princeton University.

L. John Doerrhas served as a member of our Board of Directors since May 1999. John has been a General Partner of Kleiner Perkins Caufield & Byers, a venture capital firm, since August 1980. John has also been a member of the board of directors of Amyris, Inc., a renewable products company, since May 2006, and serves on its nominating and governance committee; and Zynga, Inc., a provider of social game services, since April 2013. John holds a Master of Business Administration degree from Harvard Business School, and a Master of Science degree in electrical engineering and computer science, and a Bachelor of Science degree in electrical engineering from Rice University.

ALPHABET INC. | 2016 2024 Proxy Statement 1026